Investing in properties is becoming one of the wisest options for the NRIs to secure their money in a productive way. The Indian real estate scenario is fast changing with continuous reforms on Land Acquisition Act, relaxation of FDI rules and the Real Estate Regulatory bill. These reforms immensely eases the procedures for NRIs to invest in properties without much hitch. NRIs shall purchase or sell land either through foreign exchange (for which any Indian bank can be used as a medium) or through NRE/FCNR accounts, with a copy of it has to be submitted to the central office of The Reserve Bank of India within a period of 90 days after the purchase of the property; though no official permission is required to make the purchase and hence the buyer has all the freedom here. The permission granted by the Reserve Bank of India.

An NRI is eligible to purchase a land if he/she is residing outside the country now, PIO (Person of Indian Origin) who owned an Indian passport at any point, or someone who’s father or grandfather was an Indian citizen according to the Citizenship Act,1955 of the Constitution of India.

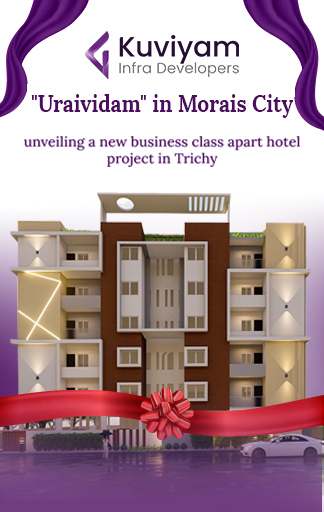

Kuviyam Infra Developers as a Real Estate endeavour has ventured into both residential and commercial properties, asserting in mind all the specifics and grandeur any NRI would fantasise. To realise this in a smooth way, Kuviyam Infra Developers is ensuring the process of investing, owning and maintaining the property in a NRI-friendly method, So venture in with trust, invest both your money, we securely assure you the rest.

The Agam Puram is a perfect choice of investment for NRIs, irrespective of the country they live in. They can invest in Agam Puram without any scepticism, as their property would not remain idle. It will be leased back and used for accommodation.

The buyers need not worry about property they buy in Agam Puram, in whichever part of the world they live in. Their property would be well taken care of by the dedicated housekeeping team deployed by the Kuviyam Infra Developers. No headache about the maintenance.

Yes! 100%. The Apartment units in Agam Puram will be leased back after the purchase and will be used for accommodation. They buyer will get an assured rent of Rs.20/sq.ft and other benefts.

They should obtain all necessary approvals and clearances from the relevant authorities, such as the municipal corporation, the state government, and the RBI. That will be assisted by Morais City Builders.

NRIs can make payments through their NRI bank accounts, using a variety of payment options such as wire transfers, online transfers, and cheques.

NRIs are subject to the same tax rules as resident Indians when it comes to investing in real estate in India. They are required to pay income tax on any rental income or capital gains earned from the property. However, NRIs are entitled to certain tax benefits, such as deductions for property taxes and mortgage interest.

NRIs can invest in real estate in India through the automatic route, which means they do not require prior approval from the RBI. The investment must be made in Indian rupees through an NRI bank account.

Yes, NRIs need to submit additional documents to avail of home loans in India, including:

Passport

PAN Card

Address proof

Power Of attorney(if investing through a representative)

NRI bank account statement

Sales agreement

Payment Receipt

Yes, NRIs need to submit additional documents to avail of home loans in India, including:

Employment contract

Salary statement

Account statement

Income tax returns

Power of Attorney(if through representative)

Yes, The attestation or notarization should be done by a public notary or a gazetted officer.

The lease agreement is for 30 years with a 5-year lock-in period. The rates will be revised based on the market condition.

The tenant is responsible for paying the House tax and GST, while TDS will be deducted and paid by Morais City.

Normal maintenance and property rent are handled by Morais City.

Major damage will be covered by the corpus fund from the investment to Morais.

Morais City will assist in selling the property and will charge 3% of the sale, provided that the buyer agrees to the 30 years lease agreement.

Tenant fixing is done by experts from Morais City to avoid grievances in the future.

The rent will start from the 4th month from the date of completion and will be processed on the 120th day.

If stagewise payments are delayed, the investor has to pay 1.25%.

The loan assistance available for an advance project finance is up to 80% from HDFC.

© 2023 All Rights Reserved By Kuviyam Infra Developers.